Future Proof Your Savings

Future Proof Your Savings

Your Savings Are SHRINKING—And You Might Not Even Notice

Your Savings Are SHRINKING—And You Might Not Even Notice

€10,000 saved five years ago? Today, it's worth 30% LESS in buying power.

Join our free online session and learn how to escape the inflation trap—before it’s too late.

€10,000 saved five years ago? Today, it's worth 30% LESS in buying power.

Join our free online session and learn how to escape the inflation trap—before it’s too late.

Join Our Webinar

Join Our Webinar

Wealth Protection Should Be Transparent—No Fine Print, No Nonsense

Wealth Protection Should Be Transparent—No Fine Print, No Nonsense

Your savings should be working for you, not against you.

But here’s the problem: Most financial systems are built to keep banks rich and you trapped.

At ClartéWealth, we believe in a better way.

🔹 No shady interest rates draining your money.

🔹 No hidden fees eating away at your savings.

🔹 No “trust us” nonsense—just clear, ethical wealth protection.

We follow strict ethical finance principles to make sure your money is safe, stable, and growing without relying on risky markets or inflation-prone currencies.

Your savings should be working for you, not against you.

But here’s the problem: Most financial systems are built to keep banks rich and you trapped.

At ClartéWealth, we believe in a better way.

🔹 No shady interest rates draining your money.

🔹 No hidden fees eating away at your savings.

🔹 No “trust us” nonsense—just clear, ethical wealth protection.

We follow strict ethical finance principles to make sure your money is safe, stable, and growing without relying on risky markets or inflation-prone currencies.

Ethical principles

Transparent

Riba Free

Learn More About Our Approach

Learn More About Our Approach

JOIN OUR 97 PERSON WAITLIST FOR THE FIRST EVER

Clartéwealth Webinar

Spaces Filling Fast!

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

Join Our First Live Webinar Waiting List!

JOIN OUR 97 PERSON WAITLIST FOR THE FIRST EVER

Clartéwealth Webinar

Spaces Filling Fast!

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

The webinar made me rethink my entire savings strategy. I started with just €100 in gold, and now I have a plan that actually works.

Islamic Finance Consultant

Even before the official webinar, I learned how gold-backed investments can protect my savings. I can’t wait for the full launch!

Early Tester in London

I appreciate how they emphasize gold and tangible assets—it’s about real, honest investing without hidden interests

Germany

I always thought investing was complicated. This session broke it down in a way that finally made sense.

Islamic Finance Postgraduate

I had trouble trusting most ‘Halal’ investment platforms. During the test session, everything was explained step by step, and I finally felt confident about where my money could go.

France

I’m not a finance expert, but the presentation was easy to follow. I liked that they showed real examples instead of just theories.

Belgium

I was worried they’d push me to sign up for something. Instead, it was more about learning and deciding if it felt right for me.

UK

I thought saving money was the responsible thing to do. Then I realized I was LOSING money every single year.

Netherlands

Join Live Webinar

What We Offer

What We Offer

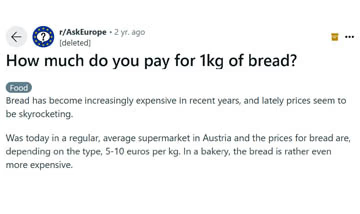

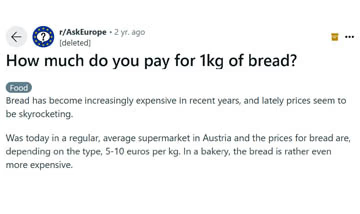

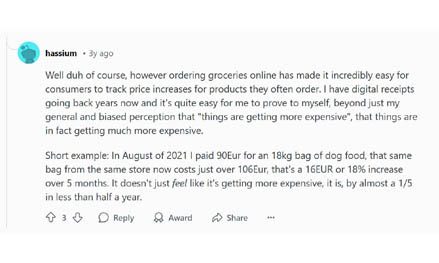

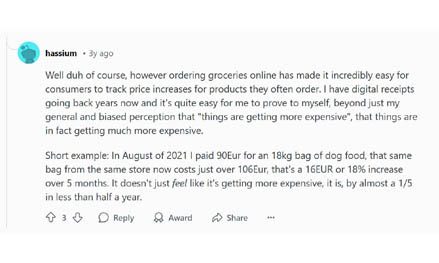

Every Day You Wait, Your Money Loses Value

Every Day You Wait, Your Money Loses Value

€10,000 saved five years ago? Today, it buys nearly 30% less due to inflation. (Source: EU Inflation Data)

Food, rent, energy—prices are climbing, but your salary isn’t keeping up.

Meanwhile, central banks are stockpiling gold—while your savings lose value.

€10,000 saved five years ago? Today, it buys nearly 30% less due to inflation. (Source: EU Inflation Data)

Food, rent, energy—prices are climbing, but your salary isn’t keeping up.

Meanwhile, central banks are stockpiling gold—while your savings lose value.

🔴 The Problem No One Talks About

🔴The Problem No One Talks About

1

Your money is trapped in a system that doesn’t protect you.

Your money is trapped in a system that doesn’t protect you.

Banks give you 0.01% interest, but inflation is eating away at your savings faster than you can save.

Banks give you 0.01% interest, but inflation is eating away at your savings faster than you can save.

Meanwhile, governments & central banks are quietly buying gold at record levels. (Source: MarketWatch)

Meanwhile, governments & central banks are quietly buying gold at record levels. (Source: MarketWatch)

2

If you’re only saving in cash, you’re falling behind.

If you’re only saving in cash, you’re falling behind.

Inflation doesn’t just go away—it compounds over time.

Inflation doesn’t just go away—it compounds over time.

Every month, your money buys less food, less rent, less security.

Every month, your money buys less food, less rent, less security.

Retirement? A home? They get further out of reach every year.

Retirement? A home? They get further out of reach every year.

3

The wealthy don’t save in cash—they protect their money.

The wealthy don’t save in cash—they protect their money.

They store value in assets that don’t depreciate—gold, real assets, safe havens.

They store value in assets that don’t depreciate—gold, real assets, safe havens.

They hedge against inflation while the average person watches their savings shrink.

They hedge against inflation while the average person watches their savings shrink.

You don’t need to be a financial expert. You don’t need to be rich.

Join Our Free Webinar Today

Join Live Webinar

All data references (e.g., 24% gold surge in 2020) based on publicly available reports from the World Gold Council

EXCEPTIONAL FEATURES

Who We Serve

Who We Serve

At Clartewealth, our goal is to help you pursue your goals, whether you’re just getting started, preparing for retirement, or well into your golden years.

I want to help my business continue to thrive, while also planning for retirement and succession

BUSINESS

OWNERS

AND

EXECUTIVES

BUSINESS OWNERS

AND EXECUTIVES

PRE-RETIREES

I want protect the wealth i'v acquired and put it to work for me so i can continue to grow my assets

PRE-RETIREES

I want protect the wealth i'v acquired and put it to work for me so i can continue to grow my assets

RETIREES

I'm already retired and want to make sure my legacy is protected (and i dont run out of money soon)

RETIREES

I'm already retired and want to make sure my legacy is protected (and i dont run out of money soon)

PRIVATE

CLIENT

I'm high income earner with complex need that require sophisticated specialized solution

PRIVATE CLIENT

I'm high income earner with complex need that require sophisticated specialized solution

I'm a young professional looking to expand my family, eliminate debt and help grow my wealth

YOUNG

INVESTOR

I'm a young professional looking to expand my family, eliminate debt and help grow my wealth

YOUNG INVESTOR

Finding Riba-Free Growth Across Europe

If you’re living in a European city like London, Berlin, or Paris, you’ve probably noticed how most banking services revolve around interest (riba). Even products labeled “Halal” can feel unclear or incomplete. You want to grow your savings, but you don’t want to compromise on values—sound familiar?

At Clartéwealth, we’ve faced the same questions. We brought in advisors who know both Islamic finance and European regulations, focusing on tangible assets (like gold) that help you avoid hidden fees and questionable claims. Our mission is simple: to show everyday people how to invest with confidence and peace of mind

Whether you’re saving for a home, a child’s education, or just looking to avoid riba-based options, we’re here to offer clear, step-by-step guidance. We’re not about flashy promises—just straightforward, long-term growth you can feel good about. Join our upcoming webinar to see how easy Halal investing can be when you have the right support.

" We believe no one should have to choose between building wealth and honoring their faith "

WE'VE GOT YOU COVERED

WE'VE GOT YOU COVERED

Frequently Asked Questions

1. How to make sure your approach is truly Halal?

2. Can I start with a small amount?

3. How does gold investment work?

4. What about Zakat on gold or other investments?

5. Does it work throughout Europe?

6. What if I am completely new to the investment world?

7. Is Halal investment risk-free?

8. How do you protect my privacy and data?

1. How to make sure your approach is truly Halal?

2. Can I start with a small amount?

3. How does gold investment work?

4. What about Zakat on gold or other investments?

5. Does it work throughout Europe?

6. What if I am completely new to the investment world?

7. Is Halal investment risk-free?

8. How do you protect my privacy and data?

Ready to Build Wealth Without Compromise?

Join Over 45 Fellow Europeans Already Signed Up for Our Halal Investing Webinar*

Join Over 45 Fellow Europeans Already Signed Up for Our Halal Investing Webinar*

What You’ll Learn

What You’ll Learn

How to begin investing in gold and other riba-free assets without breaking the bank

How to begin investing in gold and other riba-free assets without breaking the bank

Simple steps to spot (and avoid) hidden interest charges in everyday finance

Simple steps to spot (and avoid) hidden interest charges in everyday finance

A clear action plan to grow your savings ethically

A clear action plan to grow your savings ethically

Why Sign Up Now?

Why Sign Up Now?

Limited Spots: We’re keeping each session small so every question gets answered (only 20 seats left).

Limited Spots: We’re keeping each session small so every question gets answered (only 20 seats left).

Real Stories & Guidance: Hear how real people in France, Germany, and the UK overcame confusion about riba and found peace of mind.

Real Stories & Guidance: Hear how real people in France, Germany, and the UK overcame confusion about riba and found peace of mind.

No Pressure: If it’s not what you need, there’s no obligation—just honest learning.

No Pressure: If it’s not what you need, there’s no obligation—just honest learning.

Join Now

Join Now